city of richmond property tax rate

Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes. The City Assessor determines the FMV of over 70000 real property parcels each year.

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province Ontario City The Province Real Estate Buying

If you are looking for information for the City of Richmond please click here.

. Skip to Main Content. Building Department. How is property tax calculated in Richmond.

Pay Real Estate Tax. Online Tax and Utility Payment Information. Rhode Island Emergency Management Agency.

Search by Property Address Search property based on street address. 815 am to 500 pm Monday to Friday. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate established.

The median property tax also known as real estate tax in Richmond city is 212600 per year based on a median home value of 20180000 and a median effective property tax rate of 105 of property value. The total taxable value of Richmond real estate rose 73 percent in new tax assessment notices mailed to city property. Offered by City of Richmond Virginia.

3 Road Richmond British Columbia V6Y 2C1. 3 Road Richmond British Columbia V6Y 2C1 Hours. Welcome to the official Richmond County VA Local Government Website.

City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. 1000 x 120 tax rate 1200 real estate tax. Ad Get In-Depth Property Tax Data In Minutes.

450 Civic Center Plaza Richmond CA 94804 Directions Phone Numbers. Search Valuable Data On A Property. Property value 100000.

These documents are provided in Adobe Acrobat PDF format for printing. Richmond City Assessors Office 900 E. Angel Hatfield City Treasurer Email Richmond City Hall 36725 Division Road Richmond MI 48062 Staff Directory.

County schools it is 12000. Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. Richmond continues to be one of the cities with the lowest residential property tax rate in the Lower Mainland.

Richmond city collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. Broad St Rm 802 Richmond. This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc.

Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. The real estate tax rate is 120 per 100 of assessed value. Per Order 21-40 The City of Richmond will extend the filing deadline and due date for payments for the Occupational License Fees on Net Profits from April 15 2021 until May 17 2021.

Assessing. Tax line 9 less line 10 and 11 If result is negative enter zero 13. The City of Richmonds 2020 residential rate is 180065 per 1000 of assessed property value.

Start Your Homeowner Search Today. Virginia Department of Taxation For additional forms or information on other tax related items please contact the Virginia Department of Taxation at 1-804-367-8031. By Richmond City Council.

To contact City of Richmond Customer Service please call 804-646-7000 or. City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456. To pay your 2019 or newer property taxes online visit the Ray County Collectors websiteAll City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to paying 2019 or newer property taxes to the.

Car Tax Credit -PPTR. Paying Your Property Taxes. Province of BCs Tax Deferment Program.

Town of Richmond 5 Richmond Townhouse Road Wyoming RI 02898 Ph. This has also led to property tax rates of 120 per hundred in Richmond while neighboring Henrico County residents pay 085 per hundred. We have done our best to provide links to information regarding the County and the many services it provides to its citizens.

Such As Deeds Liens Property Tax More. Transfer Tax Previously Paid. Search by Parcel ID Parcel ID also known as Parcel Number or Map Reference Number used to indentify individual properties in the City of Richmond.

If you have difficulty in accessing any data you may contact our customer service group by calling 804 646-7000. This Department is responsible for maintaining general accounting records for the City billing and collecting Property Taxes and Fees and Permits. Loading Do Not Show Again Close.

Due Dates and Penalties for Property Tax. Now the schools are over 85 minority students and the spending per pupil is close to the 20000 per year mark. Property tax payments may be paid by cheque bank draft debit card or credit card a service fee of 175 applies.

Colleen Cargo City Assessor Email Richmond City Hall 36725 Division Road Richmond MI 48062 Ph. Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Understanding Your Tax Bill.

Public Alerts Coronavirus Information Read On. Tax multiply line 8 by line 4 10. Property Value 100 1000.

401-539-1089 Staff Directory Helpful Links. The City of Richmond is not accepting property tax payments in cash until March 31 2021 due to pandemic safety measures. City of Richmond adopted a tax rate.

Macomb County Homestead Tax Rate Comparisons. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. To view the Total Homestead Tax Rates for Cities Villages in Macomb County please click here.

Manage Your Tax Account. Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxes include creditdebit cards e-checks scheduled payments and automatic payments Auto-Pay. Real Estate Taxes.

Ontario Property Tax Rates Lowest And Highest Cities

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

2353 Millbrook Home Buying Real Estate Kaizen

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

This Ontario Resort For Sale Has 6 Villas Is Like Living On The Mediterranean Sea In 2022 Vacation Living Resort Mediterranean Sea

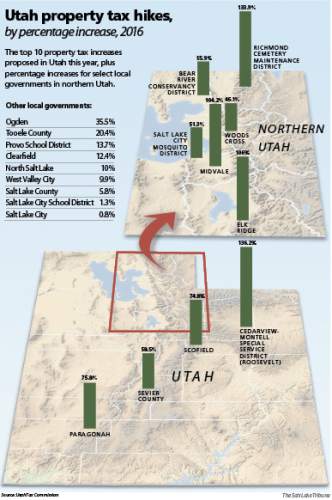

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

New York Property Tax Calculator Smartasset

Virginia Property Tax Calculator Smartasset

Many Left Frustrated As Personal Property Tax Bills Increase

Richmond Property Tax 2021 Calculator Rates Wowa Ca

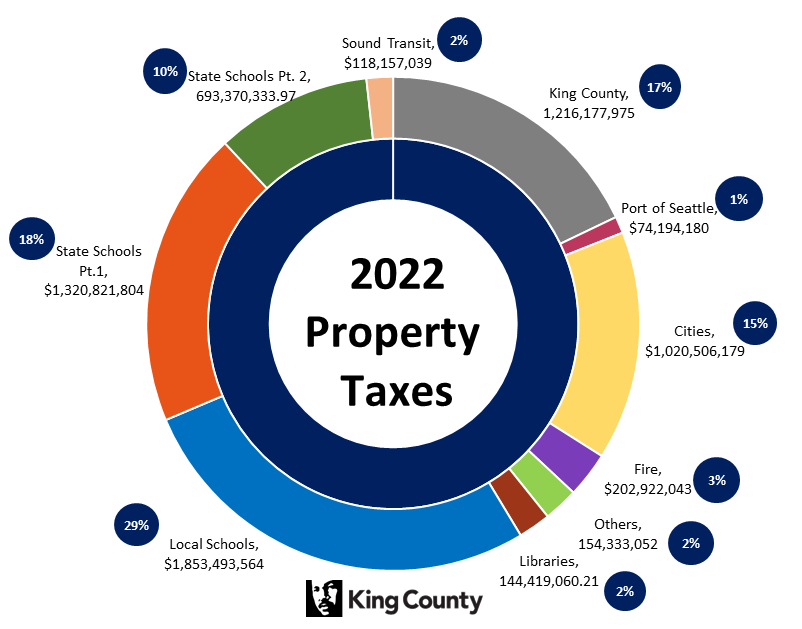

City Of Richmond Adopts 2022 Budget And Tax Rate

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province Ontario City The Province Real Estate Buying

Vermont Property Tax Rates Nancy Jenkins Real Estate

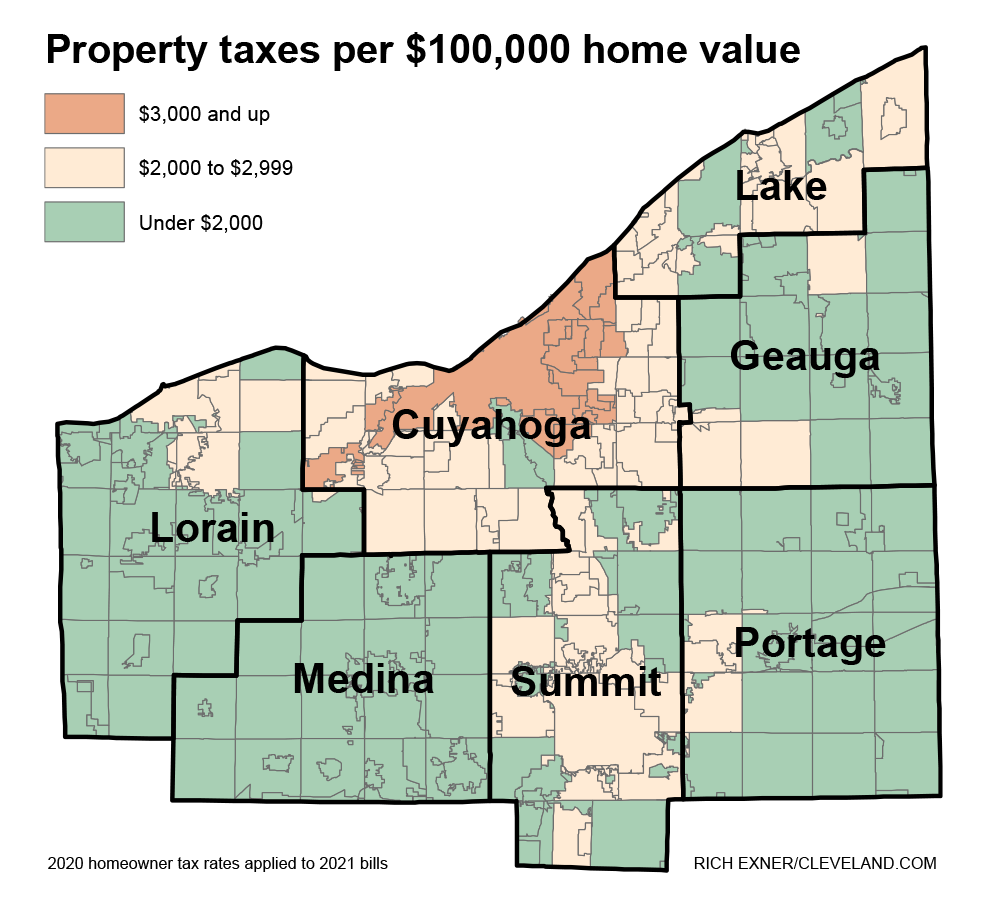

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

This Map Makes It Easy To Compare Your Property Tax Change To Your Neighbors On Top Of Philly News